Quirk Law Firm specializes in making uninsured motorist car crash automobile insurance claims. Being injured by an uninsured motorist in Ventura is as frustrating as it is scary – following an auto accident like this, contact our uninsured motorist accident law firm located in Ventura. Here are some steps in dealing with an uninsured motorist:

Step 1: Check To See If You Have Uninsured Motorist Coverage

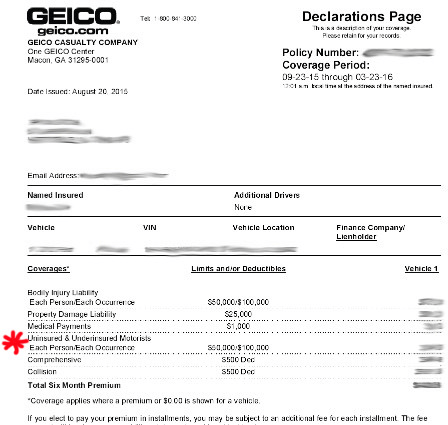

Your automobile insurance declaration page will tell you if you have uninsured motorist automobile insurance coverage. In this example, our client was hit by an insured motorist. Our client had a “50/100” Uninsured motorist coverage. That means our client could recover up to $50,000 per person or $100,000 per occurrence when he was hit by an uninsured motorist. Look at your automobile insurance policy’s declaration page to determine whether you have uninsured motorist coverage.

Even if you do not have uninsured motorist coverage listed on your insurance policy declaration page, Quirk Law Firm may find uninsured motorist coverage for you. Insurance companies must provide you a specific form deleting and/or be modifying your uninsured motorist coverage.

Step 2: Timely File An Uninsured Motorist Claim with Your Automobile Insurance Company

If you are hit by an uninsured motorist and you have uninsured motorist coverage, you should timely file a claim with your insurance company. Insurance Code Section 11580.2(i) provides a two-year statute of limitations for making claims for uninsured motorist benefits. This means within two years of your accident date, you must: (a) settle with your insurance company; (b) commence arbitration, or (c) sue the uninsured motorist and notify your insurance company.

While the state of California maintains that drivers who cause crashes should pay for them, and thereby requires all drivers to carry liability insurance, you may be able to file a claim with your own insurance company to help pay for your insurance even if you were not at fault. This is true if you have purchased uninsured or underinsured motorist coverage, which is not mandatory in the state of California. This type of insurance will help to pay for your injuries and property damage when you are involved in an accident with a motorist who does not have or does not have enough insurance.

Step 3: File A Lawsuit Against The At-fault Driver

Another option for dealing with an uninsured motorist is to file a lawsuit directly against the motorist. If the driver and/or owner of the vehicle have assets or financial means, filing a lawsuit against an uninsured motorist and/or vehicle owner can be effective. However, in many cases, the reason the driver is uninsured is because he/she could not afford insurance. As such, pursuing a civil action against an uninsured driver and/or vehicle owner may prove futile because they may not have any money for you to reclaim.

In some cases, however, filing a lawsuit against an uninsured motorist and/or vehicle owner does make sense. Quirk Law Firm’s attorneys can help you determine whether a civil action is appropriate.

Contact The Accident Attorneys At The Quirk Law Firm Today

Car accident, truck accidents, and all other auto accidents leave victims with questions about their future and how they will pay for their expenses moving forward. When you are injured by an uninsured motorist, the answers to these questions may be elusive. Injury lawyer Trevor Quirk and our accident attorneys at the Quirk Law Firm want to help you recover the compensation that you are owed.

If you are injured in a crash, call our law offices today to begin the process of recovering compensation for your losses. Reach us by email at trevor@quirklawyers.com or by phone 805-650-7778. Consultations are free.

This Blog Was Provided By:

Ventura, California 93003

Phone: 805-650-7778